Markets in the red over geopolitical tensions

Most stock markets finished the week in the red as geopolitical tensions in the Middle East continued to weigh on investor sentiment.

The UK’s FTSE 100 dropped 0.2% while pan-European Stoxx 600 and Germany’s Dax 100 slipped 0.2% and 0.1%, respectively.

Over in the US, the S&P 500 and tech-heavy Nasdaq added 0.5% and 0.9%, respectively, following positive quarterly earnings reports from Amazon, Alphabet (owner of Google), Meta (owner of Facebook) and Microsoft. However, concerns about rising expenses offset some stock gain. The Dow lost 0.1%.

In Asia, Japan’s Nikkei 225 lost 2.4%, due in part to rising bond yields. The Bank of Japan’s ten-year government bond rose to a ten-year high of 0.87%, moving closer to the central bank’s upper limit of 1%. China’s Shanghai Composite ended the week unchanged after improved industrial profit figures suggested the economy is stabilising. Hong Kong’s Hang Seng dropped 1.8% in a shortened trading week.

Last week’s market update*

• FTSE 100: -0.21%

• S&P 500: +0.47%

• Dow: -0.08%

• Nasdaq: +0.93%

• Dax: -0.11%

• Hang Seng1: -1.82%

• Shanghai Composite: -0.00%

• Nikkei 225: -2.41%

• Stoxx 600: -0.15%

• MSCI EM ex Asia: -2.47%

1Closed on Monday 23 October

*Data from close of business Friday 20 October to close of business

Friday 27 October.

UK remortgaging at lowest level since 1999

Markets across Europe and the US rallied on Monday (30 October) as investors overlooked geopolitical tensions and weak economic data. The S&P 500 grew 1.2% after falling 5% over the past ten days, while the Dow and Nasdaq gained 1.6% and 1.2%, respectively. In Europe, the Stoxx 600 added 0.4% while the FTSE 100 rose by 0.5%.

In economic news, UK net remortgaging approvals fell to 20,600 in September, down from 25,100 in August and the lowest level since early 1999, according to data from the Bank of England. Net mortgage approvals for house purchases also fell from 45,400 in August to 43,300 in September. Separate data from Zoopla showed the average UK house price has fallen 1.1% year-to-date to £246,900 as a result of weaker demand and buying power due to high mortgage rates.

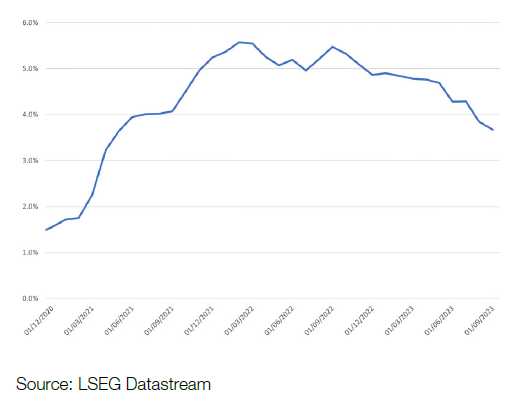

Fed’s preferred inflation measures eases

Last week saw the release of the US core personal consumption expenditures (PCE) price index – the Federal Reserve’s preferred measure of inflation. Encouragingly, the index eased to a four-month low of 3.7% year-on-year in September, down from 3.8% year-on-year the previous month.

US core PCE – annualised % change

On a monthly basis, however, core PCE rose by 0.3%, the biggest increase since May. Despite this, the Federal Reserve is not expected to raise interest rates at its next meeting on 1 November.

Separate data showed US gross domestic product (GDP) grew by an estimated 4.9% year-on-year in the third quarter, according to figures from the Commerce Department. This was better than expected and more than double the level seen in the second quarter. The rise was driven by increases in consumer spending, private inventory investment, exports, government spending and residential fixed investment.

Eurozone leaves interest rates unchanged

The European Central Bank (ECB) chose to leave its key deposit rate unchanged at 4.0% last week, marking the end to a streak of ten consecutive increases in borrowing costs. The ECB said that while inflation is still expected to stay too high for too long, it dropped markedly in September and most measures of underlying inflation have continued to ease. It added that interest rates are at levels that, maintained for a sufficiently long duration, will “make a substantial contribution” to its 2% inflation target. However, ECB president Christine Lagarde told a press conference that she would not rule out another rate increase and it was “totally premature” to discuss a potential cut.

The meeting came ahead of the release of preliminary inflation data on Tuesday morning (31 October). This showed eurozone inflation dropped to a two-year low of 2.9% in October, down from 4.3% the previous month.

Inflation accelerates in Japan

Over in Japan, Tokyo’s core consumer price index (CPI), which excludes fresh food but includes fuel, grew by 2.7% in October compared to the year before, exceeding the 2.5% rise forecast by economists. It marked the first increase in the inflation rate for four months. The index is considered a leading indicator of national price trends. ‘Core core’ CPI, which excludes both food and fuel, rose by an annualised 3.8% in October, down from 3.9% in September.

Headline CPI rose by an annualised 3.3% in October, up from 2.8% in September.